Buy Gold Bullion Online

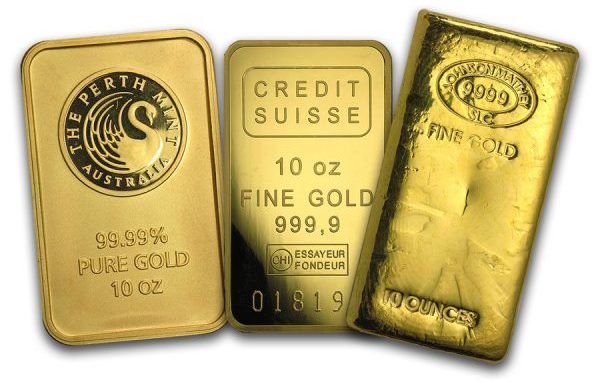

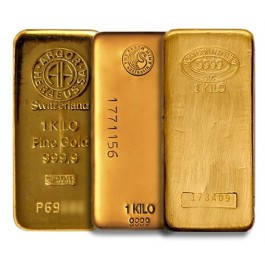

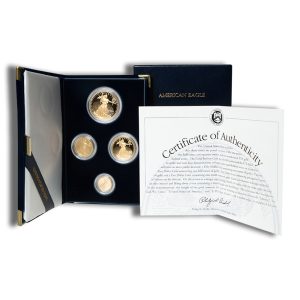

Gold has been a symbol of wealth since its first discovery more than 5000 years ago. It has been used historically, across the world,? from the great Pharaohs in Egypt to the Aztecs and the mythical El Dorado in South America. No matter where you come from, or what language you speak, everyone knows the universal currency of gold and its worth. Gold is universally accepted as an excellent investment asset. Gold is one of the 4 precious metals, accepted for their value and used for investment. Gold is rare and this adds to its value. Investors often use gold bullion, although gold coins can be also used, these are available in multiple sizes. Gold bullions are also utilized to store and protect wealth. Gold is mainly used for jewelry, it also has an important function in various technologies and dentistry and medicine

Gold vs. Bitcoin

Many people believe that bitcoin could replace gold as an investment currency in the future. Bitcoin and gold share many similarities in that they both must be obtained through mining and are available in limited quantities. Many believe that bitcoin could potentially replace gold in terms of value. However, this shift is unlikely due to the financial risk posed by bitcoin, its lack of legitimacy as a universal currency, and the resilience of gold as an investment commodity. Bitcoin still poses a great deal of financial risk due to its price fluctuation and potential termination of the system. It is also yet to achieve full status as a currency accepted worldwide. In contrast, gold is accepted by every country and has demonstrated signs of recovery since its 2013 drop. As long as investors believe it can generate profits, they will continue to choose gold over bitcoin. In conclusion, bitcoin is unlikely to replace gold as an investment asset due to the financial risk, lack of legitimacy, and resilience of gold. Until these issues can be addressed, gold will remain the popular choice for investors.